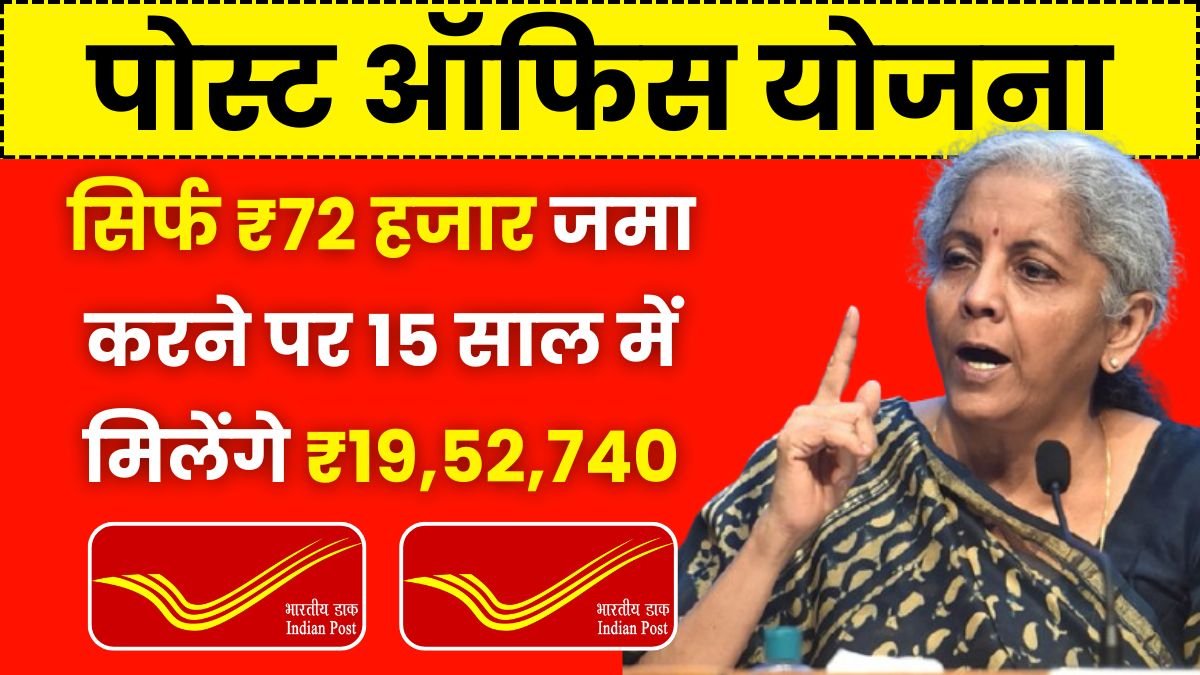

Post Office Scheme: सिर्फ ₹72 हजार जमा करने पर 15 साल में मिलेंगे ₹₹19,52,740

Post Office Scheme: कई लोग सोचते हैं कि अगर आमदनी कम है तो पैसे जोड़कर कुछ बड़ा हासिल करना मुश्किल है। लेकिन ऐसा बिल्कुल नहीं है। अगर आप हर महीने थोड़ा-थोड़ा बचाते रहें और उसे एक सही सरकारी योजना में लगाते रहें, तो वही पैसा आगे चलकर बहुत काम आ सकता है। पोस्ट ऑफिस PPF … Read more